Investment Boost New Zealand.

Investment Boost is a tax incentive to take effect immediately, enabling businesses to deduct 20 percent of the cost of taxable income for new commercial and industrial buildings, as well as a range of capital assets.

In this journal entry, we take a look at what has been announced by the Government, eligibility criteria, and how this can be applied for businesses investing into new commercial construction projects.

GO TO INVESTMENT BOOST FOR CONSTRUCTION

GO TO INVESTMENT BOOST CALCULATION EXAMPLES

What is Investment Boost?

Investment Boost is a new deduction available to New Zealand businesses when they purchase new capital assets for their business. The deduction allows businesses to accelerate the depreciation of their assets by taking a larger deduction in the year of purchase. The deduction applies to new assets purchased from 22 May 2025.

Why is the Government introducing Investment Boost?

Investment Boost supports productivity and economic growth by providing a benefit to businesses that make new investments. More investment means greater productivity and higher wages for working New Zealanders.

How does Investment Boost work?

Businesses can deduct 20% of the cost of new assets in the year that they purchase the asset. You can claim both Investment Boost and a standard depreciation deduction in the year you purchase the asset.

What assets does Investment Boost cover?

Investment Boost applies to the purchase of most assets that are depreciable for tax purposes – common examples include machinery, equipment and work vehicles. Investment Boost also applies to the purchase of new commercial and industrial buildings – that do not allow depreciation deductions.

What assets does Investment Boost not cover?

Investment Boost does not cover:

- Assets that have previously been used in New Zealand

- Land

- Trading stock

- Residential buildings (dwellings)

- Fixed life intangible assets (such as patents)

- Assets that are fully expensed under other rules.

When am I able to claim Investment Boost?

You can claim Investment Boost in your tax return for the year that you purchase the asset.

Will foreign investors benefit from Investment Boost?

Investment Boost is claimable by any business that pays tax in New Zealand. Foreign residents who invest in New Zealand resident companies will benefit from Investment Boost. These investments will increase the productivity of New Zealand workers and flow through to higher wages for the employees of these companies

Investment Boost for Construction Projects & New Buildings

Can I claim Investment Boost on new buildings?

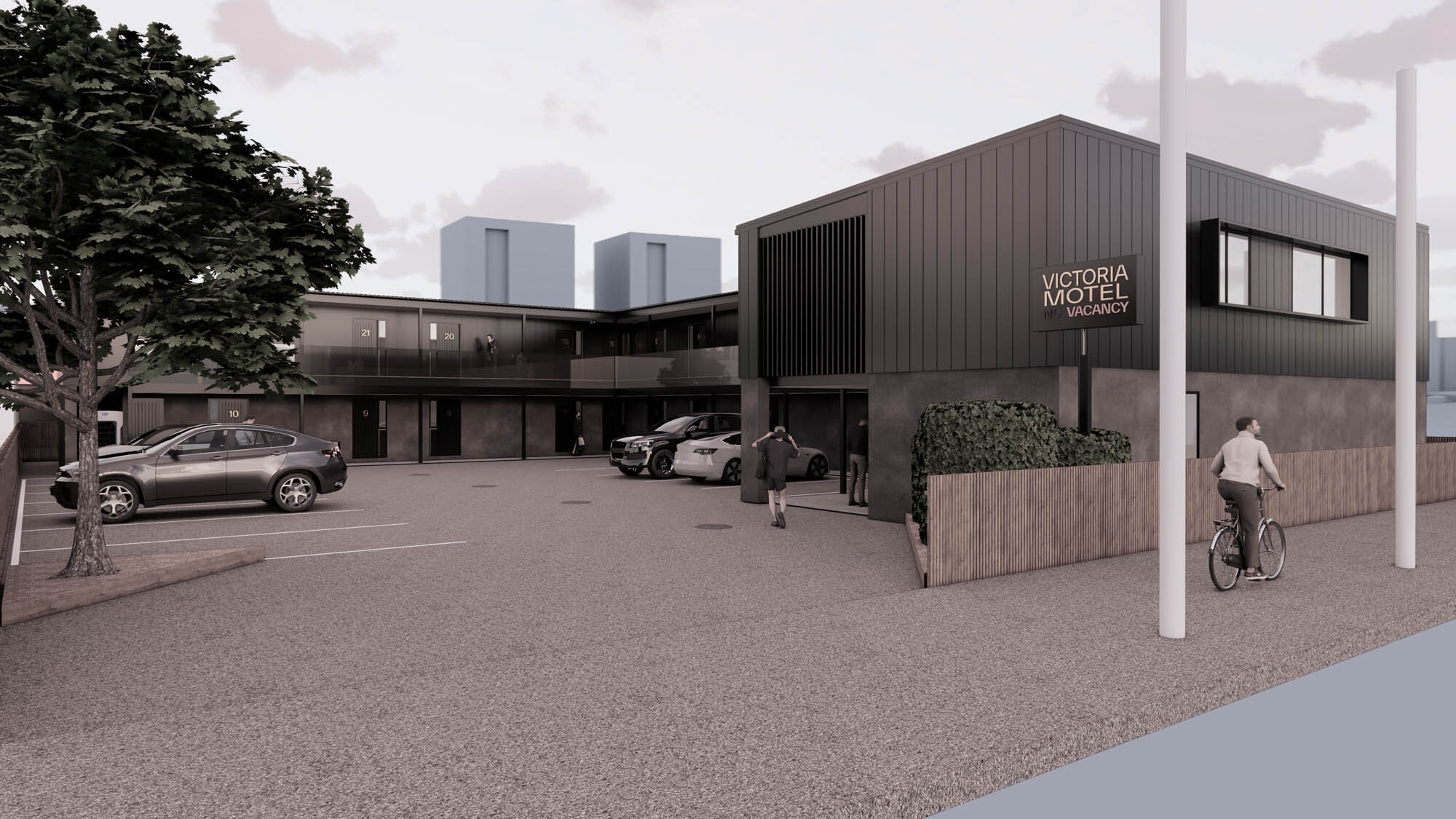

New commercial and industrial buildings are eligible for Investment Boost. Residential buildings are not eligible for Investment Boost. This means that most buildings used to provide accommodation are not eligible for Investment Boost. There are explicit exceptions for some buildings such as hotels, hospitals, and rest homes.

What if I have a construction project underway, can I claim Investment Boost when it is completed?

If you started a construction project before 22 May 2025, your asset may be eligible for Investment Boost. The asset needs to be used or available for use for the first time on or after 22 May 2025. The asset must meet the other qualifying conditions.

Are new capital improvements eligible for Investment Boost?

Yes. Improvements to depreciable property are eligible for Investment Boost if the asset that they are improving is eligible for Investment Boost. An example of an improvement is significant strengthening of an industrial building.

Is there a cap to Investment Boost?

Investment Boost applies to new assets purchased in New Zealand as well as new and used assets imported from overseas. It includes commercial buildings but excludes land, residential buildings, and assets already in use in New Zealand.

There’s no cap on the value of eligible investments. All businesses, regardless of size, can benefit.

References & Further Reading:

IRD – Tax Policy Information Boost Information Sheet

Budget 2025 – The Growth Budget Investment Boost Factsheet

Calculation of Investment Boost in Action

Example A)

If an asset, say new machinery for your business costing $100,000 with a 10% depreciation rate is acquired on the first day of the tax year, an immediate deduction is available for $20,000, and a depreciation deduction of $8,000 (being 10% of $80,000). This gives total deductions in year one of $28,000, as compared with $10,000 under existing rules.

Example B)

Let’s use a new commercial building as an example and say the total construction cost is $5,000,000 excluding gst.

Standard Depreciation (0%): $0

Investment Boost Incentive (20%): $1,000,000

In Example B, businesses will be clearly better off investing in new commercial buildings under Investment Boost, by being able to deduct $1,000,000 in year one vs. $0 under existing rules.

Note: Investment Boost does not cover the purchase of land.

Please talk to a tax professional for further information on how to calculate depreciation on your assets – we are design and build construction experts, not tax advisors 🙂

The team at Slate Architecture & Construction are ready to help you with your next commercial project and can provide a fixed-price construction contract. Using Investment Boost, investing into new assets for your business has become more affordable as we recover from an economic downturn.